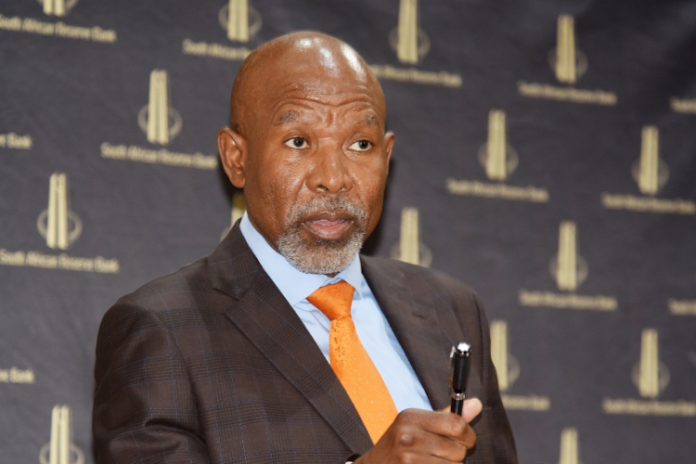

The Reserve Bank Governor, Lesetja Kganyago, had a difficult day in parliament after members of the standing committee on finance rejected the Bank’s “wishy-washy” reasoning for clearing President Cyril Ramaphosa in the Phala Phala issue.

After Kganyago presented a report to MPs on the SARB’s financial surveillance department (FinSurv) finding that Ramaphosa did not violate foreign exchange control regulations by accepting foreign currency because it was “not a perfected transaction” when Sudanese businessman Hazim Mustafa bought buffalo from Ramaphosa, accusations of “money laundering,” “thievery,” and “cover-up” flew.

Earlier, Kganyago informed MPs that the sale was incomplete since foreign currency was stolen before all necessary agreements (including, but not limited to, alerting the state vet to conduct tests on the animals and obtaining travel permissions from the Department of agriculture) were finalized.

Mzwanele Manyi of the EFF launched the first salvo, claiming it was “embarrassing” to have a sitting president implicated in a situation where “money is stuffed in sofas and mattresses.”

Manyi slammed the Bank’s conclusions, adding he was “concerned about how the bank is conducting its business.”

“The whole issue is that $580,000 found its way into the shores of this country and with all this wishy-washy explanation that we have been getting, a systemic event has been triggered.”

Manyi went on to say: “The Reserve Bank has done absolutely nothing to pursue and investigate money laundering. This should be tell-tail signs. How can after all these years you bought buffalos but you have not collected?”

His colleague Floyd Shivambu joined in, saying Kganyago “should not take us for fools”.

“There seems to be a systemic cover-up which started with the acting public protector, SA Revenue Service and now the SARB is joining into the band of cover-ups with this whitewash report to try and cover up what happened in Phala Phala thinking that we MPs are fools and that we are going to just accept this absolute rubbish.”

Shivambu accused the Bank of “undermining” South Africans by exonerating Ramaphosa and jeopardizing the Bank’s integrity.

Dion George of the DA agreed, reminding his colleagues that because the Bank is at the heart of the country’s financial institutions, its integrity must be preserved.

George asked Kganyago whether the report had been made accessible to any minister or the president if Mustafa had left the $580,000 as security, where the contract was, and why cash was taken rather than a bank guarantee.

“Did the SARB consider the impact its reasoning has on money laundering and whether persons can avoid declaring foreign currency by simply stipulating conditions in a contract? Has any action been taken previously against any individual or entity even though an entity had not been perfected?”

A seething UDM’s Nqabayomzi Nkwanka said he “detests” it when people appear before the committee and “treat us like we are stupid, we are anything but stupid”.

“This is thievery, cloaked in regulation and nice English, but this is unadulterated claptrap, if you ask me.

“If you have experience trading on the African continent and other parts of the world, all you have to do is to provide a bank guarantee to show that you have enough money in your account to show that you have enough money to take care of that transaction.”

Nkwanka said: “It’s insulting our intelligence to say because no bank guarantee was done, no processes were followed, so as the Governor is saying it’s okay to hide money in the mattress and sofas.

“When money is stuffed in the mattress, you are often evading tax, laundering money or there are issues that are intended for illegal purposes. You cannot hide money intended for legal purposes.

“If the report cannot be made public, then how can the bank’s rationale and interpretation of the law be tested, asked Nkwankwa. “This whole thing is a whitewash and a coverup.”

However, ANC’s Gijimani Skosana welcomed the report, saying: “I think it’s good that this report is presented before us as a parliament for our benefit, but also for the benefit of the public.”

Skosana said the presentation was clear in terms of the SARB’s scope in its probe. “The investigation dealt only with the contravention of exchange control regulation in relation to the foreign currency allegedly stolen in Phala Phala.

“The findings will also be limited to the scope of the investigation and there are other institutions investigating this matter and they have a broader scope to look at things like criminal activity.”

Responding to his critics, Kganyago said the Bank treated its mandate seriously.

“As the Governor and the deputy Governors, we kept an arm’s length from the investigation, we allowed our investigators latitude, we availed their massive resources, they sought external legal resources and we availed those, they traveled and got to the bottom of it.”

He said investigators then tabled a report to the executives of the Bank and they accepted it. “We sought legal counsel from outside on the report, asked questions and we got satisfied that our team acted professionally with integrity and acted independently without fear, favor or prejudice.”

Kganyago said the SARB was not responsible for the ports of entry in South Africa, Home Affairs and SARS are. “We do not have the power that the customs officials have.”

Speculating what happened in Phala Phala is also something that the Bank is not mandated to do, he said.

“Whether the money was declared to SARS or not, I would refer members to SARS for that confirmation,” he said, adding that the Bank was not investigating proceeds of crime “we were investigating the possible violation of exchange control.

“If there is money laundering that had taken place, it’s for the financial institutions to deal with those issues. Our responsibility in respect to money laundering has to do with the institutions we supervise, and that responsibility ends with the institutions having policies and systems in place to combat their institutions being abused by launderers.”

Shivambu accused the Bank of “undermining” South Africans by exonerating Ramaphosa and jeopardizing the Bank’s integrity.

Dion George of the DA agreed, reminding his colleagues that because the Bank is at the heart of the country’s financial institutions, its integrity must be preserved.

George asked Kganyago whether the report had been made accessible to any minister or the president if Mustafa had left the $580,000 as security, where the contract was, and why cash was taken rather than a bank guarantee.